Custom Made Workflow System For US Based Lease To Own Business – Case Study

Client Overview:

Okinus (the client) is a forward-thinking lease-to-own/rental business that provides flexible financing options for customers purchasing items from retail stores.

By offering credit, the client allows customers to acquire products quickly, while retailers benefit from faster inventory turnover. The company has also diversified its services to include HVAC units and other home improvement items.

Founded in 2006, the client has consistently aimed to innovate and improve its services to meet evolving market demands.

This project was a collaboration between Studio98 and Co-Foundry to further enhance Okinus’ technological infrastructure.

Client’s Challenge:

Okinus faced several significant challenges in their IT infrastructure:

- Their IT environment was spread out, utilising multiple systems including a .NET/C# system for core business operations, Salesforce for customer and marketing management, and a proprietary PHP-based e-signature and credit application platform.

- The existing systems were not only costly to maintain but also limited in scalability. With Salesforce costing over 10 thousand US dollars a month and possibly costing up to 60 thousand dollars if the company had scaled up.

- Integration between these different systems was inefficient, leading to increased manual work and hindering workflow.

- The client needed a consolidated system to reduce costs, improve efficiency, and enable scalability.

“We had a previous system that required licensing fees, and our CEO really wanted something that we could own fully. That’s when we got the task to develop our own system.” – Scott B. CTO of Okinus

The Solution:

Co-Foundry proposed a comprehensive and tailored solution:

- Migrating existing systems to a unified Laravel-based platform.

- Replicating functionalities from Salesforce and the proprietary system in the new application.

- Implementing a customer portal and a streamlined application process for credit approval and management.

- Building a workflow management system to handle credit checks, e-sign processes, and fund releases efficiently.

“The end result really is allowing us to build a system that can be continuously built on and is flexible enough to grow. As with us, we are constantly changing our collection, business, and marketing approaches.” – Scott B.

Implementation Process: Phase 1

The project was divided into two main phases, with a focus on agility and collaboration. Phase one aimed to achieve: System Migration and Replication

- Co-Foundry had to replicate the existing systems in Laravel within a tight timeframe of 4-6 months due to the impending expiration of the Salesforce subscription. The execution of this step within the timeframe was vital to avoid financial or business losses for the client.

- To deliver within the timeframe, Co-Foundry developed a field-first system architecture for Laravel to expedite the development process. This completely new and innovative tech allowed for defining data fields in a single location, significantly speeding up the creation of necessary screens and functions. As without it, the project would have taken 2-3 months longer to complete.

Implementation Process: Phase 2

Phase two aimed to achieve: Improvement and Feature Development

- After the initial migration, Co-Foundry focused on developing new features and enhancing workflows.

- They created a workflow management area within the application to manage the entire process from credit application to fund release.

- They implemented a system for retail stores to manage their accounts and customers, reducing the operational burden on the client’s staff.

- The development process followed an Agile methodology with weekly iterations, allowing for continuous feedback and adjustments.

“Being able to quickly collaborate with Greg (Founder & CEO of Co-Foundry) and his team has been a big part of that. Greg and I can talk about something that needs to be done, and chances are that just within a few weeks we can have something in beta testing. That shows to our inhouse clients or 3rd party integrations what we can do, they are usually pretty amazed.” – Scott B.

Outcome:

The collaboration between the client and Co-Foundry resulted in numerous positive outcomes:

- The unified Laravel-based platform replaced the fragmented systems, resulting in significant cost savings. The client saved hundreds of thousands of dollars annually by avoiding high Salesforce fees and reducing the need for an extensive in-house development team.

“It (Co-Foundry) saved us from having to hire a lot of inhouse developers. Inhouse developers can cost minimum 6 figures here in the US a year. And it saved us hundreds of thousands of dollars a year. Co-Foundry is kind of like having inhouse developers without having inhouse developers. “ – Scott B.

- The new system improved operational efficiency and scalability. The client could now manage workflows more effectively and integrate smoothly with third-party platforms, providing a competitive edge.

“One of the significant advantages we have over our competitors is our ability to integrate with third-party platforms. Many financing platforms want to offer “lease to own,” and the feedback I am receiving from those developers is that integrating with us has been much easier and smoother than with our competitors.” – Scott B.

- The client transformed from a semi-manual operation into a tech-driven company, leveraging the new system to handle business operations more flexibly and efficiently.

- The ability to quickly adapt and implement new features or integrations has facilitated continuous growth and enhanced customer satisfaction.

- The partnership fostered a strong, ongoing relationship, with Co-Foundry providing dedicated support and development resources tailored to the client’s evolving needs.

“Co-Foundry has been great, I love working with them. It’s nice to have some developers that understand our system (business operations). Their ability to quickly adapt and provide solutions has been invaluable to our growth and efficiency.”

– Scott B.

Overall, the strategic implementation by Co-Foundry not only addressed the client’s immediate challenges but also helped the company towards continuous growth.

Statistical Improvement:

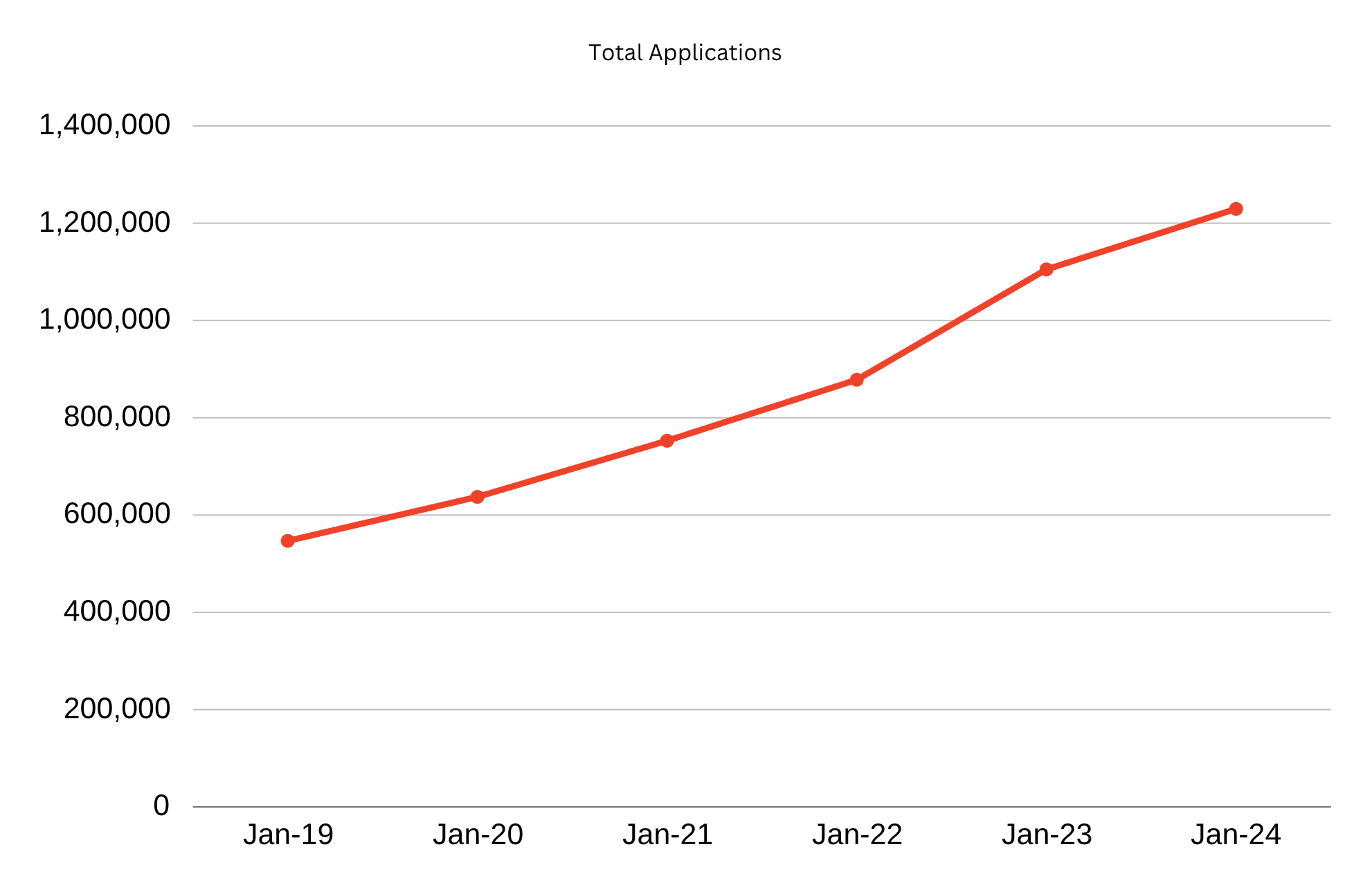

In the 13 years of operation (2006 until 2019) before collaborating with Co-Foundry, the client got a total of 546,858 applications from customers.

In the last 5 years of working together with Co-Foundry (from 2019 until 2024) the client has gotten an additional 682,552 applications that has ran through the Co-Foundry built system.

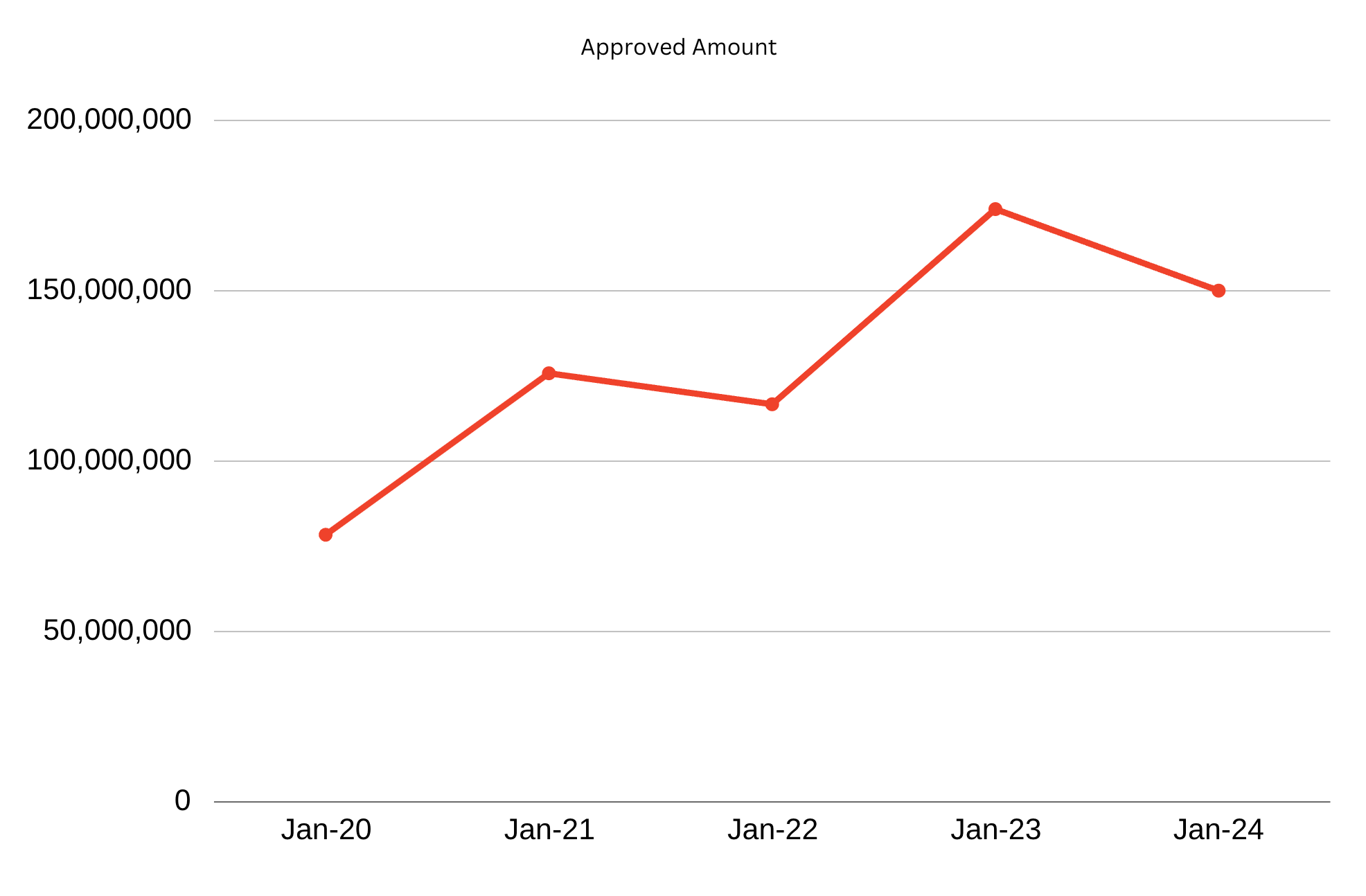

Additionally, since their inception until Co-Foundry’s involvement, the client has successfully approved & handled a total of: 78 million USD credit for customers yearly.

And in the last 5 years of collaboration, the client has grown to successfully approve, handle & manage an additional 71 million USD of credit annually with the Co-Foundry developed system.

As the client consistently grows and manages an increasing amount of funds, the system scales with them, showing no signs of breaking down under the magnitude and quantity of required data and tasks that needs to be handled.